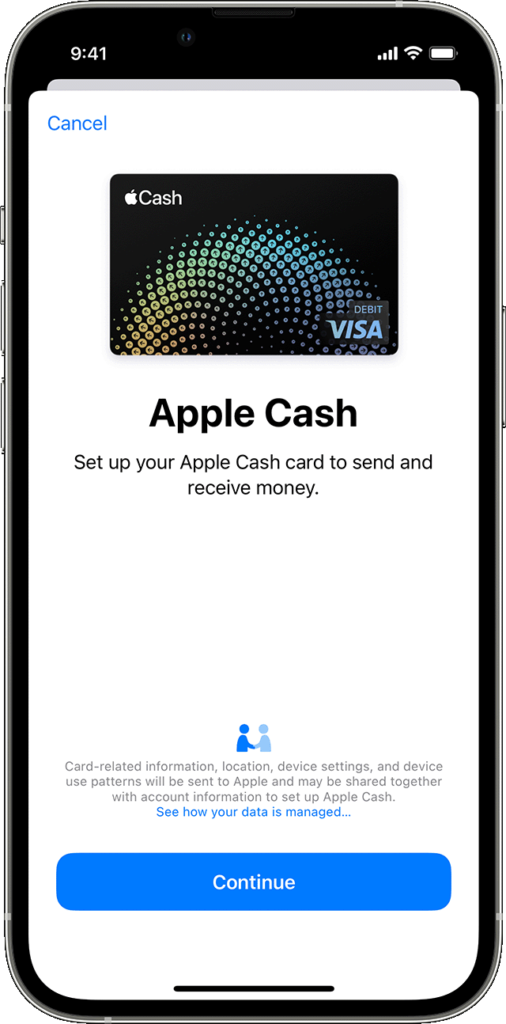

In this digital age, managing your finances right from your smartphone has become the new norm. Apple Cash, a feature in the Apple Wallet app, allows you to send, receive, and request money. But what happens when you want to transfer that money to your bank account or debit card? This guide will walk you through the process of “how to transfer apple cash to bank” step by step, ensuring you can move your Apple Cash with ease and confidence. Whether you’re a tech novice or a seasoned pro, we’ve got you covered. Let’s dive in!

How to transfer apple cash to bank?

Transferring Apple Cash to your bank is a straightforward process. Here are the steps:

- Open the Wallet app on your iPhone.

- Tap on the Apple Cash card.

- Tap on the black Apple Pay box.

- Tap Transfer to Bank.

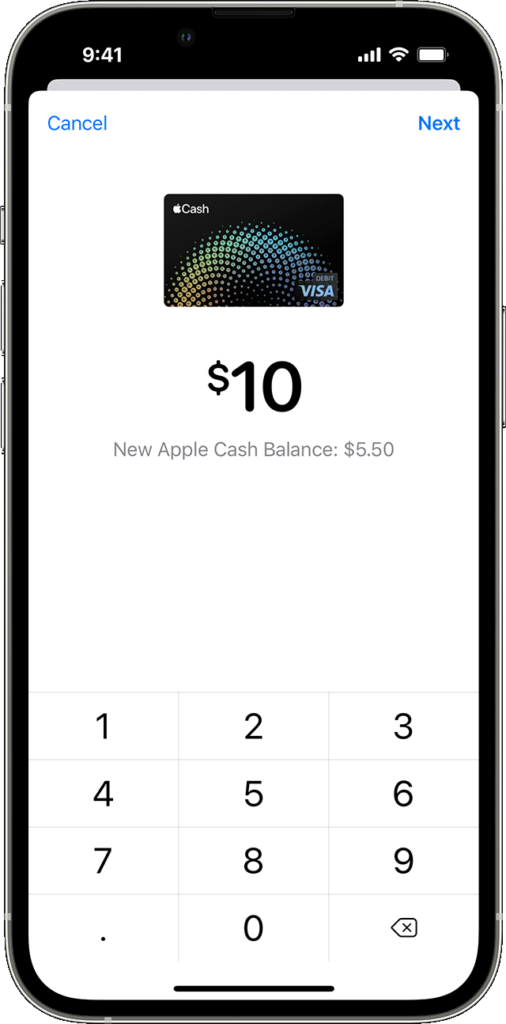

- Enter the amount you want to transfer.

- Tap next, then tap 1-3 Business Days.

- Confirm with Face ID, Touch ID, or passcode.

Please note that you need an eligible device with iOS 11.2 or later or watchOS 4.2 or later, two-factor authentication for your Apple ID, and you must be at least 18 years old and live in the United States to use this feature. Transfers to your bank account usually take one to three business days and are free.

Also Read: How to delete cash app history

How To Transfer Apple Cash to a Debit Card?

Transferring Apple Cash to a debit card is straightforward. Here’s how:

- Open the Wallet app on your iPhone or iPad.

- Tap your Apple Cash card.

- Tap the More button.

- Tap Transfer to Bank.

- Enter an amount and tap Next.

- Tap Instant Transfer.

If you haven’t added an eligible debit card, tap Add Card and follow the instructions on your screen to add a Mastercard or Visa debit card. Your funds should transfer within 30 minutes. Please note that there might be a 1.5% fee for instant transfers.

Requirements To Transfer Money From Apple Pay to Bank

To use Apple Cash and transfer money from Apple Pay to your bank, you must meet certain requirements:

- You must be at least 18 years old.

- You need two-factor authentication for your Apple ID.

- You need an eligible debit or prepaid card in Wallet.

You also need your bank’s routing number and individual bank account number. Please note that these requirements are subject to change and it’s always a good idea to check the latest information from Apple’s official website or support center.

Transfer Limits for Apple Cash

There are limits associated with using Apple Cash:

- The maximum Apple Cash balance allowed after verifying your identity is $20,000.

- Within a 7-day period, you can transfer up to $10,000 to your debit card or bank account.

- For Instant Transfer, a 1.5 percent fee (with a minimum fee of $0.25 and a maximum fee of $15) is deducted from the amount of each transfer.

Please note that these limits are subject to change and it’s always a good idea to check the latest information from Apple’s official website or support center.

Fees With Apple Cash

There are certain fees attached to Apple Cash features. For example, if a user decides to use Instant Transfer with their debit card, there is a 1.5 percent fee. This is deducted from the amount of the transfer, and the minimum fee is $0.25. The maximum fee is $15. Please note that these fees are subject to change and it’s always a good idea to check the latest information from Apple’s official website or support center.

Conclusion

Apple Cash provides an easy way for users to send and receive money right from their iPhone or iPad. Transferring money from your Apple Cash account to your bank account or debit card is straightforward and can be done in just a few steps. However, it’s important to note that there are certain requirements and limits associated with using this service.

Whether you’re splitting bills with friends or making purchases online, understanding how to use these features can help you make the most out of your digital wallet experience.

FAQ

- What’s the Difference Between Apple Cash and Apple Pay?

Apple Cash and Apple Pay are two different services offered by Apple, each with its own unique features.

Apple Cash is a virtual card that exists within the Wallet app on your iPhone. You can use it to send and receive money through the Messages app. Once you receive money, it’s added to your Apple Cash card, and from there, you can send it to others, make purchases using Apple Pay, or transfer it to your bank account.

On the other hand, Apple Pay is a mobile payment and digital wallet service that lets you make payments using your iPhone, iPad, Apple Watch, or Mac. It doesn’t have a cash balance like Apple Cash. Instead, it uses the debit and credit cards you’ve added to your Wallet to facilitate transactions.

So in essence, Apple Cash is a virtual card that may have a cash balance, whereas Apple Pay is a tool that performs transactions.

- Why won’t my Apple Cash transfer to my bank?

There could be various reasons why your Apple Cash won’t transfer to your bank. It could be due to technical issues like poor Wi-Fi or cellular connection, outdated iOS or iPadOS version, incorrect account credentials, or even some kind of bug.

If you’re having trouble transferring money from your Apple Cash account, try turning off Apple Pay Cash, powering down your device, then turning on Apple Pay Cash again. If this doesn’t work, it’s recommended that you contact Apple Support.