If you are new to forex trading, you might feel like you are learning a new language. Three things that you need to know are “spreads,” “pips,” and “pipettes.” For people who want to trade forex, understanding these words is very important. This guide will show you what is a Pip in Forex, how to calculate them, and how they are different from pipettes. You’ll have a good understanding of these ideas by the end of this piece. This is very important for people who are new to the forex market.

How to Read Pips in Forex Trading?

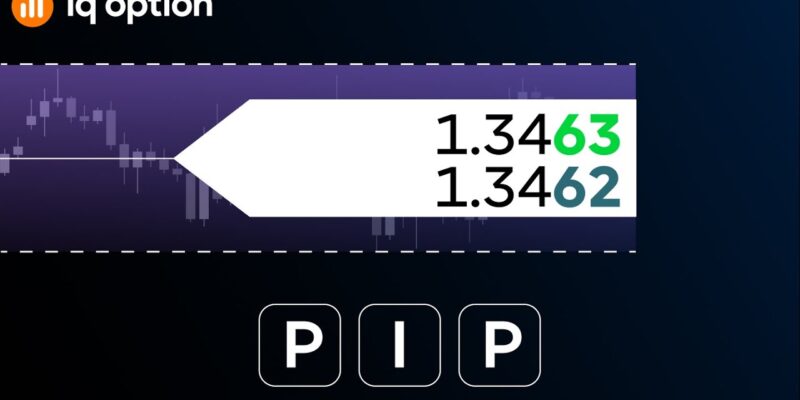

In case you’re new to forex trading, you might be thinking about what “pips” really means. “Pip” means “points in percentage,” and it’s the smallest change that two currencies can make to each other.

But let’s begin with the base

What Is a Pip in Forex? (Fully Explained)

In the foreign exchange market, a “pip” is the common unit used to track changes in the value of two different currencies. It shows the smallest change that can happen in the value of two currencies. In the world of currency dealing, pips are often called “points,” and they are worth about 1/100th of a cent. When used in the forex market, “pip” can stand for either “percentage in point” or “price interest point.”

How Are Pips Used?

A pip is a unit used to measure how much the exchange rate between two currencies has changed. It is found by using the fourth decimal place, except for pairs of Japanese yen (JPY), where it is found by using the second decimal place. It is important to remember that pips do not have a fixed value in cash. The value of a pip changed based on the size of the trade.

Some examples of pips in pairs of currencies

Take a look at the EUR/USD exchange pair to see how pips work. A rise of one pip means that the exchange rate went from 1.1080 to 1.1081.

If you want to buy EUR/USD, you will make money when the value of the euro goes up against the US dollar. A dealer would have made 45 pips if they started the trade at 1.1081 and stopped it at 1.1126. If the market went against the trade, on the other hand, a loss would be made.

When comparing pairs of Japanese yen, like USD/JPY, going from 10.44 to 10.43 means a drop of 1 pip. Traders who buy USD/JPY benefit when the dollar gets stronger against the Japanese yen. The user would have made 53 pips if it started at 10.43 and ended at 10.96. If you move backwards, you will lose.

How to Figure Out Pip Value

A pip’s value depends on the trade size, the exchange rate, and the currency pair being sold. The pip value is a key point to use when judging the success of a trade, no matter if it made money or lost money.

To find the pip worth, multiply one pip (0.0001) by the size of the lot or contract. A standard lot is 100,000 units of the base currency, and a small lot is 10,000 units.

Take the EUR/USD pair as an example. With a standard lot, a one-pip change is equal to $10 (0.0001 x 100,000).

“Pip value” equals 100,000 times 0.0001 (one pip).

Consider Ten dollars’ worth of Pip

For every positive pip movement, you make $10, and for every negative pip movement, you lose $10. Remember that the value of a pip changes between sets of currencies because exchange rates change all the time.

What Is a Spread in Forex?

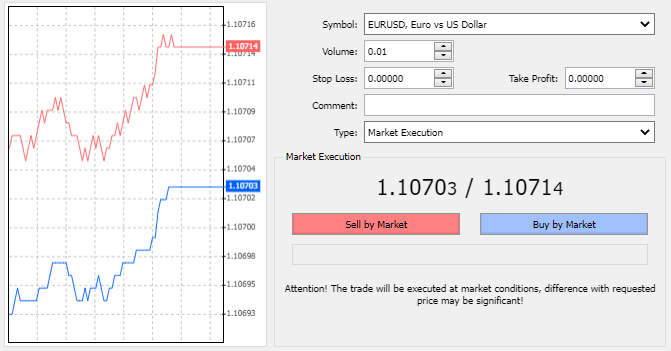

The gap between the bid and ask prices for a currency pair is called the “spread.” This idea isn’t just used in forex; it’s also used in stocks, commodities, and cryptocurrencies, among other markets.

How to Calculate Spread in Forex?

Before getting into spreads, people who are new to trading should understand what “bid” and “ask” prices mean. If you want to sell the base currency, the “bid” price is the right price. If you want to buy the base currency, the “ask” price is the right price. You can find these prices in the trade platform MetaTrader 4.

How to Tell the Difference Between Pipettes and Pips

To be clear, a pip measures changes to the fourth decimal place, while a pipette measures movement to the fifth decimal place. When trading Japanese Yen, a pip represents changes in the second decimal place and a pipette represents changes in the third decimal place.

How Many Pips Do Forex Traders Make Daily?

Every day, traders can make any number of pips they want. The amount of pips earned is based on many things, such as trading strategies, market changes, and technical and fundamental analyses. The foreign exchange market is naturally unstable, and while all buyers hope to make money every day, the truth is much more complicated. Stick to a well-thought-out trading plan, keep coming up with new methods, and use good risk management techniques.

Getting to Know Ticks and Points

‘Tick’ and ‘point’ are words that are often used in different trade situations. Like a pip, a “tick” is a unit of measurement, but the units may not be the same on all devices. It varies. Some devices measure in 0.0001-unit steps, while others may measure in 0.25-unit steps.

A “point,” on the other hand, is a unit of measurement that shows how much the dollar amount has changed. Traders call a change in the price of a stock from $25 to $30 a “five-point movement.” When talking about changes in the fifth decimal place in forex, the words “point” and “pipette” can be used instead of each other.

In Closing

To sum up, it’s important for all traders to know what is a pip in Forex, but especially those who are new to forex, to understand pips, pipettes, spreads, and other technical terms used in the market. These ideas will become second nature as you keep dealing, which will help you get around in the complicated world of forex trading.