Artificial intelligence (AI) is rapidly transforming industries across the globe, making it a hotbed for investors seeking growth and innovation. From healthcare to finance, AI’s reach is vast, offering a plethora of opportunities for savvy investors. This guide will navigate you through the complex yet exhilarating world of AI investments and will answer the question “how to invest in ai”.

Why Invest in Artificial Intelligence?

AI is not just a buzzword; it’s a substantial economic driver. According to industry analysts, the AI market is expected to grow exponentially in the coming years. Investing in AI can be a way to leverage this growth, as companies that incorporate AI technologies often lead in efficiency and innovation.

Investing in AI offers compelling reasons due to its transformative impact across industries:

Economic Impact

AI significantly boosts efficiency and innovation, contributing to economic growth and creating competitive advantages for companies that adopt its technologies.

Sectoral Expansion

AI’s applications are vast, affecting sectors from healthcare to finance, indicating a wide array of investment opportunities.

Future Relevance

As technology evolves, AI’s role in driving future technologies and services ensures its long-term relevance and potential for robust returns.

Investing in AI not only aligns with current technological trends but also positions investors at the forefront of future innovations.

How to Invest in AI: Different Approaches

Investing in artificial intelligence (AI) offers a variety of paths, each suited to different investment styles and risk tolerance levels. Here, we explore several practical methods to invest in this innovative technology.

1. AI Stocks

Investing directly in AI stocks is a popular approach for those looking to have a direct stake in companies at the forefront of AI technology. Here’s how to get started:

- Research and Identify: Start by identifying companies that are leaders in AI technology or are heavily integrating AI into their operations. Look for both established tech giants and emerging players.

- Evaluate Financial Health: Analyze the financial stability, growth trajectory, and innovation capacity of these companies. Financial news sites and stock analysis platforms can provide comprehensive data and forecasts.

- Diversify Your Portfolio: Consider diversifying your investments across different AI companies and sectors to mitigate risk.

- Monitor and Adjust: Keep an eye on how AI developments affect your stocks and be ready to adjust your investments as the market evolves.

2. AI ETFs and Mutual Funds

Exchange-Traded Funds (ETFs) and mutual funds that focus on AI can offer a more diversified investment option. Here’s a step-by-step guide to investing in AI through these financial instruments:

- Select the Right Fund: Choose ETFs or mutual funds that specifically invest in AI technologies or in sectors that are significantly influenced by AI advancements.

- Check the Fund Performance: Look at the historical performance of the fund, but also consider the management fee and the fund’s strategy to ensure it matches your investment goals.

- Invest Regularly: Consider setting up a regular investment plan to benefit from dollar-cost averaging, which can reduce the impact of volatility.

3. Venture Capital and Private Equity

For those who are more adventurous and have access to more capital, investing in AI through venture capital or private equity could be highly rewarding. Here’s how you can proceed:

- Connect with VC Firms: Identify venture capital firms that specialize in technology or specifically in AI startups. Networking at tech events or online platforms can be a good start.

- Evaluate Opportunities: Participate in funding rounds of startups you believe have potential. Detailed due diligence is crucial to assess their market viability and technology.

- Stay Engaged: Unlike public stocks, investing in private companies may offer chances to engage with the business more directly, influencing its direction and strategy.

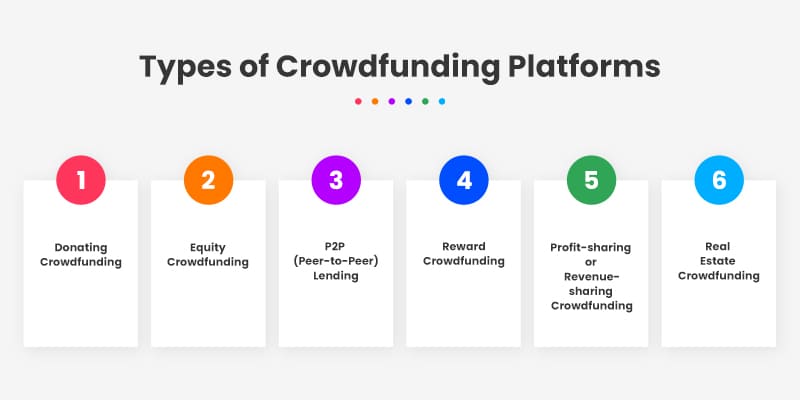

4. Crowdfunding Platforms

Investing in AI startups through crowdfunding platforms is another accessible option that allows individuals to invest small amounts in emerging companies. Here’s how to engage with crowdfunding:

- Select a Platform: Choose a reputable crowdfunding platform that lists technology startups with a focus on AI.

- Research Potential Startups: Similar to venture capital investments, do thorough research on the startup’s business model, leadership team, and product.

- Understand the Risks: Be aware of the higher risks involved in crowdfunding investments, including the potential loss of your investment and the lack of liquidity.

5. Robo-Advisors

For those new to investing or preferring a hands-off approach, robo-advisors that utilize AI to optimize investment strategies might be appealing. Here’s how to utilize this method:

- Choose a Robo-Advisor: Select one that offers tailor-made portfolios based on advanced AI algorithms and your personal risk tolerance.

- Set Your Investment Goals: Provide your financial goals, timeline, and risk preference to tailor your investment strategy.

- Monitor and Rebalance: Even though robo-advisors automate most processes, regularly check in on your investment’s performance and adjust your settings as your financial goals evolve.

Each of these methods offers a unique entry point into the AI investment landscape, tailored to different levels of capital outlay, risk tolerance, and involvement in investment management. By understanding and utilizing these diverse approaches, investors can position themselves to capitalize on the growth potential that AI technology offers.

Risks and Considerations

Investing in artificial intelligence, while promising, involves several risks that are crucial for investors to understand and consider:

Market Volatility

The AI industry is subject to rapid technological changes and market dynamics, which can lead to significant price swings in AI-related stocks and assets. Investors should be prepared for possible abrupt market movements that can affect the value of their investments.

Regulatory and Ethical Issues

AI technology raises unique regulatory and ethical concerns, including data privacy, surveillance, and decision-making biases, which can influence public perception and lead to stringent regulations. These factors can impact the profitability and operational scope of AI companies.

High Competition and R&D Costs

AI is a highly competitive field with significant expenditures on research and development. New entrants and ongoing innovations can quickly outpace existing technologies, making some AI investments less attractive or obsolete. Investors need to choose companies that not only innovate but also effectively manage their R&D spending.

Dependence on Data

AI systems rely heavily on vast amounts of data, which can pose risks related to data quality, accessibility, and privacy. Poor data can lead to ineffective AI solutions, reducing the investment appeal of certain firms or technologies.

Technological Complexity

The complexity of AI technologies can be a barrier for investors to fully understand the products or services offered by AI companies. This complexity requires investors to have a higher degree of diligence to comprehend how a company’s technology works and its potential market impact.

Integration and Adoption Challenges

While AI offers substantial improvements in efficiency and performance, the integration of AI systems into existing infrastructures can be challenging and costly. Additionally, market adoption rates can vary, affecting the expected profitability and growth of AI investments.

Understanding these risks is essential for managing potential impacts and making informed decisions in the AI investment space.

Future Prospects of AI Investments

The potential for AI investments remains robust as the technology continues to evolve and penetrate various sectors. Here’s a closer look at what the future may hold:

Accelerated Growth in Diverse Sectors

AI’s influence is set to expand beyond traditional tech sectors into areas like agriculture, education, and public services, providing new investment landscapes. As AI tools become more advanced, their applications in solving complex global challenges like climate change and healthcare are expected to attract substantial investments.

Advancements in AI Capabilities

Continuous improvements in machine learning algorithms, neural networks, and computational capacities promise to unlock more sophisticated AI applications. These advancements could spur new business models and investment opportunities, particularly in industries reliant on data analysis and automation.

Increased Adoption of AI Solutions

As AI technologies become more cost-effective and accessible, their adoption across small and medium enterprises (SMEs) is likely to increase. This broader adoption can lead to a surge in productivity and innovation, opening up more markets for investors.

Regulatory Developments

The regulatory landscape for AI is expected to mature, providing clearer guidelines and frameworks for development and deployment. This will likely aid investors by reducing uncertainty and fostering a stable environment for AI companies to grow.

Ethical AI and Public Trust

Investors might also witness a rise in the emphasis on ethical AI development as public awareness of AI’s social impacts grows. Companies that prioritize ethical considerations in their AI deployments may gain a competitive advantage and attract more investors conscious of corporate responsibility.

Integration with IoT and Other Technologies

The integration of AI with other emerging technologies such as the Internet of Things (IoT), blockchain, and quantum computing could create synergies that magnify the capabilities and impact of AI. This convergence is expected to drive innovation and create lucrative investment opportunities in newly forming tech ecosystems.

Conclusion

Investing in AI offers exciting opportunities but demands diligence and a keen understanding of technology trends. Whether through stocks, ETFs, or direct startup investments, navigating the AI investment landscape requires a balanced approach to risk and a forward-thinking mindset.

By incorporating the key insights and strategic advice outlined in this guide, you are better equipped to make informed decisions and potentially reap the benefits of the transformative power of artificial intelligence