Order blocks play a crucial role in forex trading as they provide valuable insights into the intentions of big players in the market. Understanding how to use order blocks effectively can greatly enhance your trading strategy and increase your chances of success. In this blog post, we will delve into the concept of order blocks in forex and provide you with a comprehensive guide on how to utilize them in your trading journey.

What are order blocks in forex trading?

Order blocks in forex trading refer to specific price levels or areas on a chart where large financial institutions or central banks accumulate or distribute significant amounts of a particular currency pair through one big order or multiple orders. These blocks represent key supply and demand zones where big players enter the market.

Central banks and institutions often split their orders into blocks to avoid causing excessive volatility in the market. They may use sophisticated techniques, such as showing only a small portion of the actual order size, to mask their involvement. By identifying order blocks, traders can gain insights into the intentions and activities of these major market participants.

Types of order blocks in Forex

In the context of forex trading, “order blocks” is a term often used in a specific trading methodology known as “order flow trading.” Order blocks represent areas on a price chart where significant buying or selling activity has occurred. These areas are believed to have an impact on future price movements. It’s important to note that the concept of order blocks is not universally recognized or used by all forex traders, and the terminology may vary among different trading approaches. However, I can provide you with some commonly referred to types of order blocks in forex trading:

- Supply Order Blocks

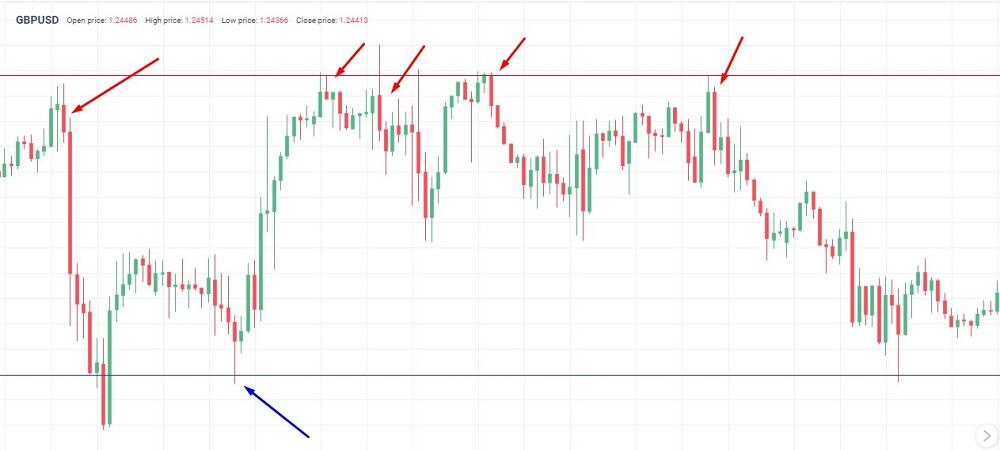

Supply order blocks are areas on a price chart where selling pressure has been significant, resulting in a reversal or a pause in an upward price trend. Traders who use supply order blocks often look for opportunities to sell or short the currency pair when the price revisits these levels.

- Demand Order Blocks

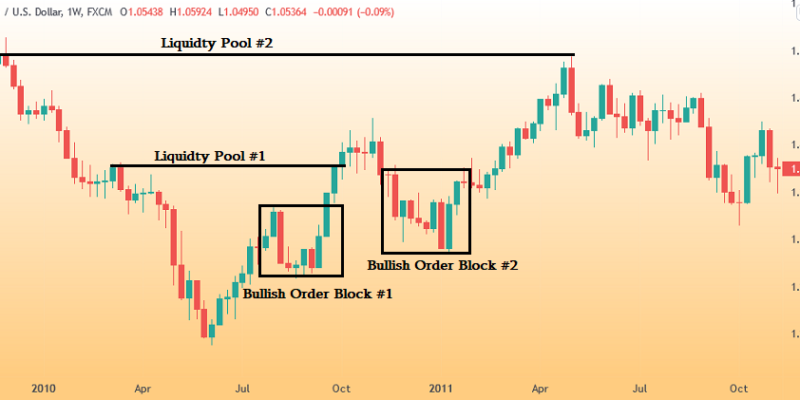

Demand order blocks are areas on a price chart where buying pressure has been significant, resulting in a reversal or a pause in a downward price trend. Traders who use demand order blocks often look for opportunities to buy or go long the currency pair when the price revisits these levels.

- Stop Order Blocks

Stop order blocks refer to areas on a price chart where a cluster of stop orders from traders has accumulated. These stop orders are typically placed by traders to automatically execute a trade when the market reaches a certain price level, either to limit losses (stop-loss orders) or to enter into a trade (buy-stop or sell-stop orders). When the price reaches a stop order block, it can trigger a significant move in the opposite direction due to the execution of these orders.

- Breakout Order Blocks

Breakout order blocks are areas on a price chart where the price has previously consolidated within a range or a pattern. Traders who use breakout strategies often monitor these blocks because they anticipate that a breakout from the consolidation will lead to a significant price move. They may place orders to enter trades when the price breaks above or below the boundaries of the order block.

Remember that the effectiveness and reliability of these order blocks may vary, and it’s essential to conduct a thorough analysis and consider other factors before making trading decisions. Additionally, different traders may have their own variations or interpretations of order blocks based on their trading strategies and methodologies.

How to spot order blocks in forex?

Spotting order blocks in forex requires a combination of technical analysis and an understanding of price action. While the concept of order blocks is subjective and may vary among traders, here are some general steps you can follow to identify potential order blocks:

- Identify Significant Price Movements

Look for areas on the price chart where significant buying or selling pressure has resulted in strong price movements. These can be large bullish or bearish candles, long wicks, or price spikes.

- Mark Swing Highs and Lows

Identify swing highs and lows on the price chart. Swing highs are peaks in price where the market has reversed from an upward trend, while swing lows are valleys where the market has reversed from a downward trend. These swing points often indicate areas of potential order blocks.

- Draw Support and Resistance Levels

Plot support and resistance levels on the price chart based on areas where the price has previously reversed or consolidated. These levels can act as potential order blocks when the price revisits them.

- Look for Consolidation or Range-Bound Areas

Identify areas on the chart where the price has been consolidating or moving within a range. These periods of consolidation often represent order blocks, as they indicate a balance between buying and selling pressure.

- Analyze Volume and Price Action

Pay attention to volume and price action around swing highs, swing lows, and consolidation areas. Look for increased buying or selling pressure, such as high volume, strong candlestick patterns, or significant price rejections.

- Consider Multiple Timeframes

Analyzing order blocks on multiple timeframes can provide a broader perspective. Look for alignment or confluence of order blocks across different timeframes, as this can increase their significance.

- Validate with Other Technical Tools

Use other technical indicators or tools, such as trendlines, moving averages, or Fibonacci retracements, to support your analysis and confirm the presence of order blocks.

It is important to note that spotting order blocks requires practice, experience, and a deep understanding of price action. It’s important to combine order block analysis with other technical and fundamental analysis techniques to make well-informed trading decisions.

How to use order blocks in forex?

Using order blocks in forex trading involves incorporating them into your trading strategy and decision-making process. Here are some ways you can use order blocks in your forex trading:

- Support and Resistance Levels

Order blocks can act as support and resistance levels on the price chart. When the price revisits these levels, it often reacts to them, providing potential trading opportunities. You can use order blocks to identify key levels where you expect the price to reverse or consolidate.

- Entry and Exit Points

Order blocks can serve as entry and exit points for your trades. For example, if you identify a demand order block, you might consider entering a long trade when the price revisits that block, expecting a bounce or reversal. Conversely, if you identify a supply order block, consider entering a short trade when the price revisits that block.

- Trade Confirmation

An order block that can act as a confirmation tool for your trading decisions. If you’re considering a trade based on other technical indicators or patterns, the presence of an order block in the same area can strengthen your conviction in the trade, increasing the probability of a successful outcome.

Stop Placement

Order blocks can help you determine appropriate stop-loss levels for your trades. Placing your stop-loss orders beyond significant order blocks can provide a buffer against potential price reversals and limit your risk exposure.

- Trade Management

Order blocks can assist in managing your trades. As the price approaches an order block, you can monitor price action and volume to assess whether the block is likely to hold or break. This information can help you make decisions about adjusting your take-profit levels, trailing stops, or exiting trades.

- Breakout Trading

Order blocks can be useful for breakout trading strategies. When the price consolidates within an order block, a breakout above or below the block can signal a significant price move. You can use order blocks to identify potential breakout levels and enter trades accordingly.

- Market Analysis

Analyzing order blocks across different currency pairs and timeframes can provide insights into broader market sentiment and potential price reversals. Observing order blocks in conjunction with other technical and fundamental factors can help you develop a comprehensive market analysis.

Order blocks are just one tool among many in forex trading. It’s important to combine them with other technical analysis techniques, risk management principles, and your trading plan to make informed trading decisions. Additionally, practice and experience are crucial for effectively incorporating order blocks into your trading strategy.