Almost most of the traders have heard of the word leverage trading. But a much smaller portion of them actually knows what leverage trading is, how it works and even if it’s a good idea to start trading with leverage. In this article, we will be covering this very exact topic: what is leverage trading? How can one use it? and whether it suits you and your financial plans or not. So sit tight and enjoy the article.

Leverage Trading

Leverage trading is the reason why most traders choose to trade in the cryptocurrency market and forex. Rather than trading in stock markets which has lower leverage rates. The amount of allowed leverage is much higher in the crypto market and forex. But is that a good thing? That’s another story which we will also talk about in this article.

What is Leverage Trading?

Leverage trading is the act of borrowing money to enter a position, which can be helpful and destructive. The idea of borrowing money to put into your business is not a new thing. In the financial world, this act is called leverage trading. In the crypto market, leverage trading is done in centralized exchanges.

Exchanges borrow money from traders so they can invest it in their positions. So the rewards would be much higher than trading without the borrowed money. On the other hand, the money you lose when your trade goes wrong is also much higher.

The question that comes to mind is why would someone do leverage trading when it has a greater risk of losing money?

The answer is simple. While leverage trading has a larger risk of losing money than trading with your original margin, the profit of leverage trading is also much greater. So if your trade goes right and you have entered the right position, leverage trading can be very helpful for you.

How does Leverage Trading work?

Leverage trading in the crypto market is a contract between the trader and the exchange offering leverage trading. Usually, leverage trading in the crypto market comes in two different forms: future trading and margin trading, but that’s another story. Forex leverage trading is done by brokers lending money to traders so they can trade with larger margins. So basically the same principle applies in all financial markets, the only difference is in the details and the names.

How is the leverage calculated?

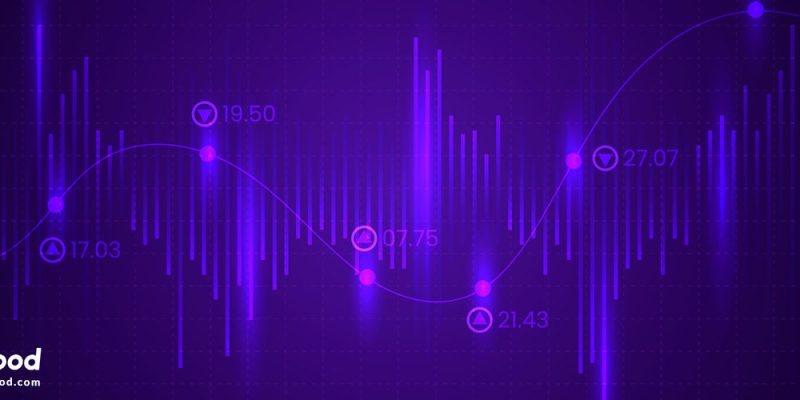

One of the most important aspects of leverage trading is the amount of leverage applied to the trade. If you miscalculate or mistakenly choose higher leverage, the risk of your position will be greatly increased.

Leverage trading is designed so traders could use their initial margin and in a relatively shorter time, increase their margin in size. So the principle here is that traders could make a lot of money with a few price changes. For example, in a non-leveraged trade, if the price drops 1%, you would lose 1% of the margin you put in the position. In a position with 10:1 leverage though, if the price drops 1% you would lose 10% of your margin. Imagine what would happen if you were trading with a 100:1 margin!

To calculate the total mountain of margin in your leveraged position, you have to multiply the amount of leverage by your initial margin.

For example, if you are trading with a 10:1 leverage, and you are putting $1,000 in the position, your total margin would be $10,000. Your profit or loss in that position would be calculated according to your total margin which is $10,000. So if the asset you’re trading goes up %10, you would gain 10 percent of $10,000 which is $1000. On the other hand, if the asset drops %5 you would lose half of your margin, and if it drops %10 all your margin is gone now!

Although leverage trading in the crypto market (through exchanges) is almost the same as leverage trading in Forex, the result can be different. You’ll find out why in the next section.

Is Bitcoin Leverage Trading safe?

This is true that leverage trading in forex works the same way as it does in the crypto market. But the outcome and the risk is the difference between leverage trading in these two financial markets.

For example, if you are trading with leverage on a crypto asset like Bitcoin (BTC), the risk of you losing your money can be higher than, say, leverage trading on gold (XAU) in Forex.

The reason why leverage trading on Bitcoin carries more risk than gold in Forex is that the crypto market is you and the prices are extremely volatile. Volatility is a reason why Bitcoin leverage trading is riskier than gold leverage trading (or any other asset in Forex for that matter).

Another reason why Bitcoin leverage trading has more risks is market manipulation. Because it doesn’t usually happen in Forex as it’s a felony. On the other hand, market manipulation is very common in the crypto market. Whales (traders who own a lot of Bitcoins), exchanges, and banks can easily manipulate the market. And they usually will, and make a ton of money doing so.

That’s why leverage trading in the crypto market is riskier than leverage trading in Forex or other stock markets.

Conclusion

Leverage trading is a way in which traders borrow money from exchanges or brokers. So traders gain more money when they profit from their position. It also opens the door to more risks. As traders will lose more money if the trade goes wrong as well.

So leverage trading is a double-edged sword. It can help you gain financial security and it can also destroy your portfolio. But you don’t need to worry, if you know what you are doing, how leverage trading works, and how to manage risks, you won’t be having much trouble.

Q&A

Is trading with leverage a good idea?

If you know how leverage trading works, Yes. It allows traders to have more buying power than their original portfolio, so they will profit much more than trading without leverage. But it goes both ways as they will lose money more than trading without leverage too.

Do you pay back leverage?

Yes. By leverage trading, you are borrowing money from the exchange to enter a larger position than you could with your initial margin. When you close the position, you have to pay back the leveraged margin plus some interest.

Can you lose more than you invest with leverage?

The short answer is, Yes. Even if the position you opened goes horribly wrong and it closes with a %100 loss, you will only lose the initial margin you put in to open the trade. You should pay attention to your futures contract as it can differ from exchange to exchange.