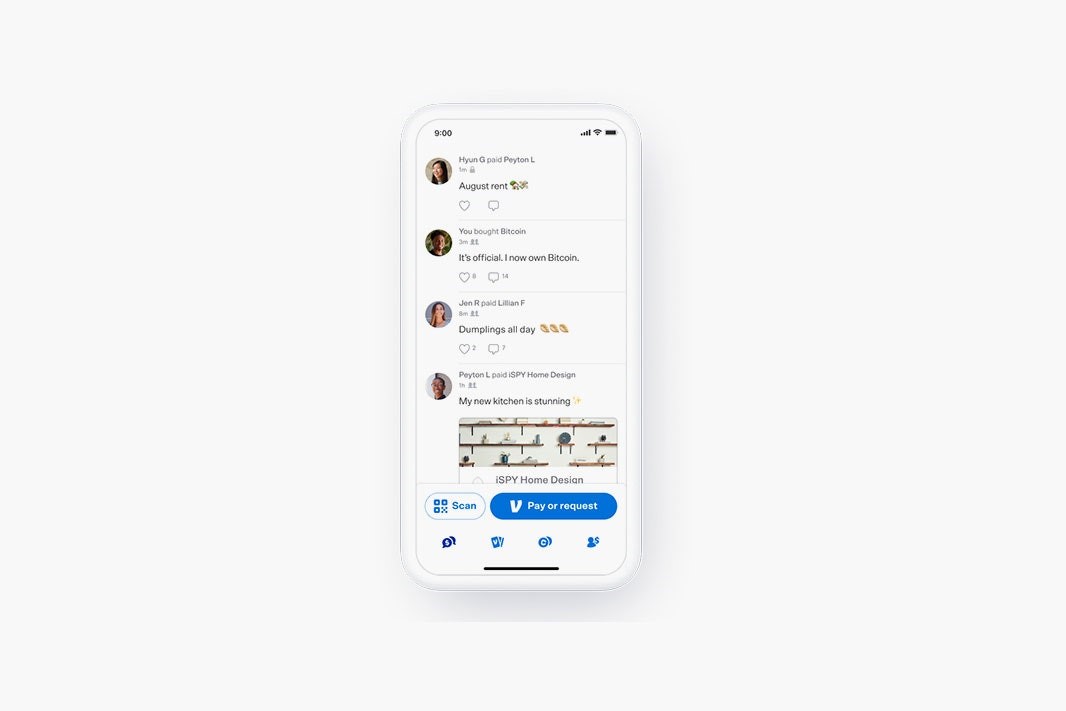

with venmo You can send money to anyone who uses the app. All you need to do is sign up for free and then sign in. Then, go to your profile and tap on the “Pay or Request” button. Next, enter the email address or phone number of the person you want to send money to. Then, type the amount you want to send and a note if necessary. Once you’ve completed your transaction, you can send your friend a payment.

You can send money to friends using the app, but you can’t request money. soon we’ll discuss is venmo safe, how does venmo work and is it safe, how does venmo work,is it safe and how does venmo work to receive money. stay tuned.

To send money to someone, you’ll need to download the Venmo app and find a “Vendor” button. Click the button that looks like a pencil and a square. Then, input the recipients, the amount, and a note. To personalize the transaction, you can choose to make it private or public. You’ll never see the exact amount on your timeline, but it will be available on your profile.

You can send money to anyone through Venmo by linking your bank account. this is how venmo works. You’ll need your routing number and account number to do this. To receive money, all you have to do is select the recipient, enter the amount you want to send, and confirm your payment. Once you’ve verified your account and linked your bank account, you’re ready to send payments. And don’t forget to keep your password safe. This will prevent your information from being stolen. this is how safe is venmo.

your funds aren’t insured with the Federal Deposit Insurance Corporation, so you have nothing to worry about if the app doesn’t function properly. And when you do buy something, you can use the app to pay for it.

When using the app, be sure to keep the information safe. Don’t ever share it. In case you lose the phone, you can cut off access to your Venmo account. Simply unlink it and sign out of the app. Similarly, avoid sending money to someone who could use it to scam you. And if you do lose your phone, you’ll need to disable the option for transferring money.

The security of your Venmo account is extremely important. so you should know what is venmo and how does it work and is venmo secure. You can trust the app and its safety by using the password correctly. If you’re a victim of a cyber-attack, you can be sure that you’ll get your money back if you lose it on the same day. If you’re worried about the safety of your data, don’t hesitate to use the free Venmo service to make the payment.

what will be covered in this article:

- what is venmo and how does it work

- how does venmo work to receive money

- how does venmo work and is it safe

- is venmo secure and how safe is venmo

What is Venmo?

Venmo is an online payment service that lets you send money to other users of the service. While you can use the service to request payments from other people, you can’t request money from other users. In order to use Venmo, you must have an app installed on your phone. Simply press the Venmo button (it looks like a square and pencil) to send money. After you’ve selected the amount and the recipients, you can add a note and emojis. since this platform is becoming popular, we’ll cover all about what is venmo and how does it work and is venmo safe.

is venmo secure? is venmo safe? The app is safe to use, and you can use it to send and receive money from people anywhere. Transactions on Venmo can be private or public, and you can choose which ones to share. You can also choose whether to share the money publicly or privately. Then, you can send money to as many people as you want. Once you’ve established a payment method, you can send and receive payments with the app.

To send or receive money through Venmo, you’ll first need to register an account with the service. After you’ve registered, you can then connect with other users, collect payments, and send payments. To send a payment, simply choose the recipient and indicate the amount you wish to send. You can also choose the reason you’re sending a payment and confirm your transfer. Using this app is fast and secure, and it can be used to make purchases at your local stores or online stores.

how venmo works? this payment app makes it fun to send and receive money. Unlike most other payment apps, it also makes paying people easy. With Venmo, you can scroll through the transaction feed and describe the transaction in a way that is meaningful to you. Then, you can choose to transfer the money to the person you want to send the money to. If you have a credit card, you can use it to make payments.

You can also add friends using Venmo via the app. Once you’ve added them, you can send money by name or username. You can also add friends by scanning a QR code on the app or in person. If you’re meeting a friend in person, you can scan the QR code and then send money to them. This will show them your profile. This service is very easy to use, and it is the perfect choice for people who don’t want to wait for their payment to arrive.

It is easy to link your bank account to Venmo. This is important for security reasons. A hacker can access your bank account if you link the two. By default, you can make payments on Venmo if you have a credit card with the same name as the other person. You can also make payments on Venmo without a bank account. You can send and receive money to and from other users of Venmo. The funds can be transferred instantly, which is a huge advantage for the service.

up next we’ll discuss what is venmo and how venmo works.

How does venmo work?

Well, venmo is a simple service that allows you to send and receive money from other users. You can also make payments from other Venmo users, which is a great convenience for those who want to send small amounts of money to people. You can connect your credit card and debit card to your Venmo account, and then you can send and collect payments from anyone. The process is simple, and you can even choose emojis to make your payments even more fun. this is how venmo works.

A payment made with Venmo is done with a 3% fee. This fee is higher than the standard rate on a credit card transaction, but it is still lower than the 2.75% fee that banks charge for the same transaction. Once you have completed the transfer, your money will be in the recipient’s bank account within a few minutes. When you send a payment with a Venmo card, you will receive a receipt in your email.

Unlike traditional banks, Venmo doesn’t have a minimum balance requirement. Instead, it requires a user to link a credit or debit card. This means you don’t need to have a credit card to send and receive money from friends or family. Those who have linked their credit card can pay instantly without any fee. But, to avoid the 1% fee, it is recommended that you have at least $2 in your bank account.

If you want to make sure that your money is safe when using Venmo, you need to disable the “transaction sharing” feature and set the privacy setting on your account. When sending money to people with whom you aren’t familiar, you should ask whether the payment will be made or not. When sending money from an online classified site, you should ask the seller to confirm the payment before you send it.

Just be sure to make sure the person you’re paying is listed as your friend on the app, so that you can identify them by picture and name.

Is venmo safe?

If you’re concerned about the safety of Venmo, you’re not alone. More than 30 million people use the service, and there have been cases of fraud. But, don’t worry. There are several ways to make your account safer. Here are some tips to make your account more secure. Once you’ve signed up, you can set up a PIN code or biometric access. These options require a unique identifier.

When transferring money with Venmo, you should move it to your bank account and avoid leaving large sums in your account. You should also make your account private. You should check the security settings and change them as needed. For additional protection, you should turn on notifications. This will help you track login attempts and requests. This way, you won’t be at risk of fraud. If you’re worried about fraud, you should never leave large sums of money in your Venmo account.

Venmo also protects your account from cyber attacks. It monitors every transaction and flags suspicious activity. You should use a credit card for all purchases, since banks and debit cards don’t accept it. When you’re ready to receive funds, you can link your bank or credit card to your Venmo account. It’s also possible to add or remove devices from your safe list, which can help prevent fraudulent activity.

You should link your Venmo account with a credit card to protect yourself from scams. If you ever lose your phone or your computer, you can block access to your Venmo account. Having a separate credit card linked to your Venmo account is a good idea because it protects your financial information from cybercriminals.

Remember that a public Venmo account is vulnerable to hackers. This means that a hacker can use your account to steal your funds. If you’ve already sent money to someone else, it’s important to make sure they don’t send you money to someone they don’t know. It’s essential to verify your contacts before sending money. You can even link your Venmo account to your credit card to protect yourself from unauthorized charges.

Venmo has multiple layers of security. It uses bank-level encryption, but it’s not foolproof. There are people who get hold of your Venmo login details, and they can transfer money from your bank account to their own. That’s why Venmo offers multi-factor authentication, allowing you to pair your fingerprint with your Venmo password. If you’re worried about this, you can also set up a PIN code and use it with fingerprint identification.

What are the Venmo fees?

Sending money over Venmo triggers a standard 3% fee. The 3% fee is not waived when users send money from a credit card.The fees for these services are relatively low, and can be avoided if you know what to look for. When making purchases through Venmo, it will charge a 1.5% fee. You can transfer funds to a debit card of your choice within three days of receiving the payment.

Adding a bank account to your Venmo account is not required. But it is encouraged. It helps verify your account. While the app offers other ways to add money, adding a bank account is a good idea for verification. It also helps to ensure that the person receiving the money has a real bank account. Scammers have started targeting people using the app via social media, email, and text message.

When you first sign up for Venmo, you can send up to $5 per week. However, you will need to verify your identity by providing your social security number and zip code, as well as your date of birth. Afterward, you can send up to five money orders per week. As for the other fees, these are minimal. You can use your Venmo card to send cash. You can also make purchases using the app.

The fees vary by type of transaction. If you are sending money to another U.S. bank account, you’ll need to add a debit card or credit card. You can even pay for goods and services through Venmo. Once you’ve added a debit or credit card, you’ll have to pay the Venmo fees. The fees will vary depending on the amount you send. Generally, you’ll never pay more than the total balance of your account.

The fees charged by Venmo vary from user to user. When sending money, you can include a note about the transaction. The payment protection provided by Venmo means that the payment will be protected and you won’t have to worry about fraud or theft. If you have any concerns about the fees, contact the company and let them know that you’re willing to pay for the goods and services you’re buying.

Are there any alternatives to Venmo?

If you’re tired of paying a fee to send and receive money through Venmo, it’s time to look for an alternative. Fortunately, there are a number of popular options to choose from. Unlike Venmo, Braintree charges a low 2.9% plus $.30 per transaction, which is much less than the hefty fees associated with Venmo. Skrill is an ecommerce platform that lets you manage all your online transactions from one account. Using Skrill makes online payments, allows you to fund your wallet, and transfers funds to other accounts fast. The platform also offers currency exchange rates and offers many other features.

Venmo is a social network that has recently added purchase protection. While PayPal has many advantages, you’ll have to be mindful of the privacy risks that come with this app. The payment app is public by default, but you can change this setting if you’d like to be more discreet. You’ll also need to be aware of your own digital privacy policies. If you’re looking for a more secure and private alternative to this popular service, try out Apple Pay, Facebook Pay, or Google Cash. If you want to be fully anonymous, you can use PayPal for international payments.

One of the most popular alternatives to Venmo is Zelle. You can use the bank’s mobile app or download the Zelle app to use it with other online payment services. With Zelle, you can send money to friends and family with just a few taps of your smartphone. You’ll be notified of the recipient’s payment via email or text message. Unlike with Venmo, Zelle is free to use. It also supports a variety of payment methods, including PayPal, Apple Pay, and Google Pay.

If you don’t want to deal with high transaction fees and are worried about losing customers, a peer-to-peer payment app is a great option. With this service, you can send money without any fees using your bank account. You can also use the app to receive paychecks and buy cryptocurrency. If you’re a small business owner, however, you can use Venmo as an alternative for a fast and easy way to send money to friends and family.

How Does Venmo Work With Taxes?

Before you send money to friends, you may be wondering: How does Venmo work with taxes? If you’ve ever sent money to a friend via Venmo, you know that it’s automatically taxable. While this is true for many types of business payments, it’s not true for personal ones. This article will go over how to properly report the money you receive from friends using the Venmo app.

The first thing to understand is that money exchanged through Venmo is not taxable. Although it’s convenient for customers, you need to maintain detailed records if you plan to report the money to the IRS. For this reason, you should use a different payment service provider if you are running a business or self-employed. These companies won’t issue form 1099’s to you, so you won’t have to worry about bookkeeping.

When using Venmo to make purchases, be sure to keep the invoice or receipt for your records. When sending payments to vendors, remember to send a Form 1099-MISC to them to show you’ve paid them. As a payment settlement entity, Venmo doesn’t send Form 1099s. To avoid tax trouble, follow good business practices and report your transactions. In this way, you can reduce the risk of penalties.

Once you’ve made a transaction through Venmo, you can fill out your Schedule C to claim your expenses. If you’re self-employed, you’ll need to calculate your self-employment taxes by using a self-employment tax calculator. Moreover, you’ll need to keep a record of your transactions for the past three years. When filing your taxes, make sure to report all payments to the IRS.

As with any payment method, the Venmo app uses Form 1099-K to report the income you receive. This is an informational tax form, and it’s important to report your income on your tax return. You may even be required to report payments to your creditor or other business that you’ve made through the app. Nonetheless, you should always avoid making personal payments to strangers.

As a self-employed person, you should be paying taxes on the total income you earn every year. The new legislation does not change your tax liability. If you receive a form from someone you don’t know, you should not send it to the recipient. You’ll be asked to pay taxes on any income you receive. For example, if you make a gift, you should include that expense in your receipt.

in case you still don’t know what is venmo and how does it work, is venmo secure and is venmo safe, leave a comment to get a more detailed explanation.