You might have heard the name of the Discover Balance Transfer, a credit card that people and organizations may use for several reasons, such as transferring balances with a lower interest rate, saving money, and paying off their debt faster. If you want to know more about the Balance Transfer credit card details and how people use it to create a plan to pay off their debt and manage their finances more effectively, read this guide till the end.

What is a Balance Transfer Credit Card?

A Balance Transfer credit card is a type of credit card that allows you to transfer the balance of one or more credit cards to another credit card. It is usually used to consolidate debt, simplify payments, and save money on interest charges. In this way, when you transfer a balance from one credit card to another, you the balance on the original card with the new card, which means the balance to the new card issuer, typically at a lower interest rate. Many balance transfer credit cards offer an introductory period with 0% interest on balance transfers, which can help you save money on interest charges. Balance transfer credit cards typically charge a fee for the service, usually a percentage of the amount transferred, and its fee can vary depending on the credit card issuer.

Does Discover allow balance transfers?

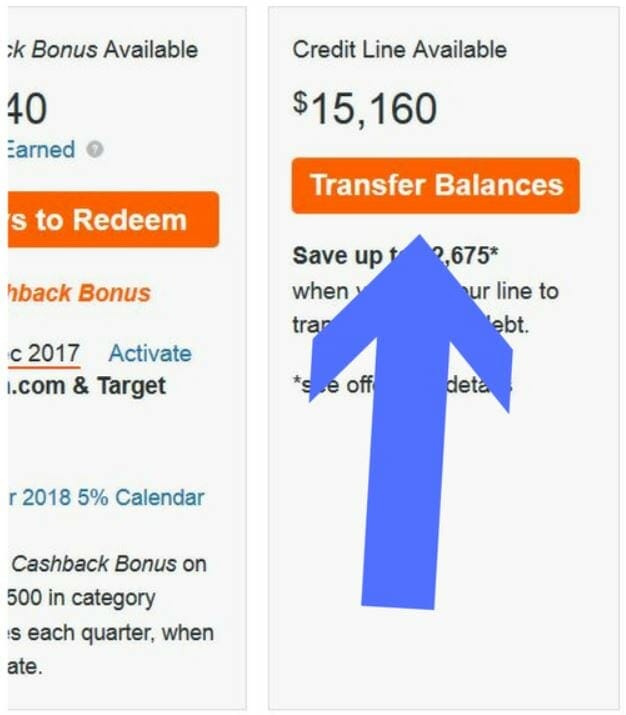

Yes, Discover allows balance transfers. Discover is known for offering balance transfer credit cards with competitive rates and promotional periods with 0% interest on balance transfers. To initiate a balance transfer with Discover, you can do it online through your account or by calling their customer service. While Discover typically charges a balance transfer fee of 3% of the amount transferred, with a minimum fee of $5, it is available with no balance transfer fees or lower fees.

Also, I should add that almost all credit cards are eligible for balance transfers with Discover, but it is best to first check with Discover or the card issuer to confirm eligibility.

How to Transfer Credit Card Balance in Discover?

Now, you might ask about the best way to transfer your credit card balance to Discover cards, which is not hard to explain. To transfer a credit card balance to a Discover credit card, follow these steps:

- Apply for a Discover credit if you still need one. You can do this online or by calling Discover’s customer service.

- Gather the information for the credit card account(s) you want to transfer balances from, including the account numbers and the amounts.

- Log in to your Discover account online, or call Discover’s customer service to initiate the balance transfer. The credit card account(s) you want to transfer balances ready.

- Follow the prompts to complete the balance transfer. You may provide additional information, such as the name and address of the credit card issuer and the account holder.

- Review the terms and conditions of the balance transfer, including any fees, interest rates, and promotional periods. Make sure you understand the terms and conditions before completing the balance transfer.

- Once the balance transfer is complete, monitor your accounts to ensure the transfer is processed correctly. It may take several days for the transfer.

- It’s important to note that Discover typically charges a balance transfer fee of 3% of the amount transferred, with a minimum of $5.

How can I transfer money from Discover?

To transfer money from Discover, you will need to have a Discover account and set up the appropriate transfer method. The type of transfer, there may be fees or limits on the amount of money, you can transfer. Be sure to review the terms and conditions of your Discover account and the transfer method that initiates any transfers. The below list shows some of these important options:

- Balance transfers:

As we discussed earlier, Discover allows you to transfer balances from high-interest credit cards to Discover credit cards. It can be done during the application process or later through your account online or over the phone.

- Direct deposit:

You can set up direct deposit for your paycheck or other regular income directly into your Discover account.

- Online bill pay:

Discover’s online bill pay feature allows you to pay bills from your Discover account. You can set up one-time or recurring payments for utilities, credit cards, and other bills.

- External transfers:

You can transfer money between your Discover account and accounts at other banks or financial institutions. It is through Discover’s online banking portal or mobile app.

- Check deposits:

You can deposit checks into your Discover account by using Discover’s mobile app to take a picture of the or by mailing the check to Discover.

- ATM withdrawals:

You can withdraw cash from your Discover account at ATMs that accept Discover cards.

Discover it Balance Transfer rewards

The Discover it Balance Transfer card offers rewards for using its balance transfer benefits. These rewards can be a great way to earn additional benefits while also taking advantage of the balance transfer benefits of the Discover It Balance Transfer card. Just be sure to review the terms and conditions of the card to ensure that you understand the rewards program and any associated fees or limitations. Here are some of the rewards you can earn with this card:

- Cashback rewards:

The Discover it Balance Transfer card offers 5% cash back in rotating categories that change every quarter, such as gas stations, grocery stores, restaurants, and more. You can earn 1% cashback on all other purchases.

- Cashback match:

At the end of your first year with the card, Discover will match all the cash-back rewards you earned. It can double, making this card choice for people looking to maximize their rewards.

- Refer-a-Friend bonus:

You can earn a $50 statement credit for each friend you refer to Discover who gets approved for a Discover card. Your friend will also receive a $50 statement credit.

- FICO Credit Score:

Discover provides free access to your FICO credit score, which can help you stay on top of your credit and make better financial decisions.

How to cancel a Discover balance transfer?

If you want to cancel a Discover balance transfer, you can do so by contacting Discover’s customer service department. Here are the steps you can take to cancel a balance transfer:

- Call Discover’s customer service: You can call the customer service number on the back of your Discover card billing statement to speak with a representative. Be prepared to provide your account information and details about the balance transfer you want to cancel.

- Request to cancel the balance transfer: Tell the representative that you want to cancel the balance transfer and provide the account information for the transfer.

- Verify cancellation details: The representative will verify. Be sure to ask any questions about the cancellation process, such as when the cancellation will take effect.

- Monitor your account: After canceling the balance transfer, monitor your account to ensure that the transfer is not processed and that any associated fees to your account.

- It’s important to note that canceling a balance transfer may result in additional fees or interest charges, depending on the terms and conditions of your Discover account.

- Review your account agreement and speak with a representative if you have questions or concerns about canceling a balance transfer.

Also Read: “Cash App Direct Deposit“

FAQ:

- What is the balance transfer fee for Discover it?

It is a 3% intro balance transfer fee, up to a 5% fee on future balance transfers.

- How long does it take for Discover to transfer balance?

Usually, it takes between seven and 10 days.

- How often can I do a balance transfer?

Your account should be open for 14 days before you want to use Discover to process your balance transfer.

- Why you might want the Discover it® Balance Transfer

You can earn cashback rewards in rotating categories, providing a way to effectively double your first-year cashback earnings.

Conclusion:

In the above text, you read about Discover card balance transfer, what it is, why people use it, and different ways you can use it to reach all your goals in the shortest time and the easiest way. If you like them and have any extra questions, you can check the discover balance transfer official site and ask your question to their support team.