Are you looking for the best payment gateway to help you take card payments online? If so, you’re in the right place! In this article, we’ll look at five of the best payment gateways that offer secure and simple payment processing for businesses of any size. We’ll explain the pros and cons of each, so that you can make an informed decision about which is best for your needs.

You can also read: The 5 Best Free Movie Streaming Sites You Can Use On Any Device

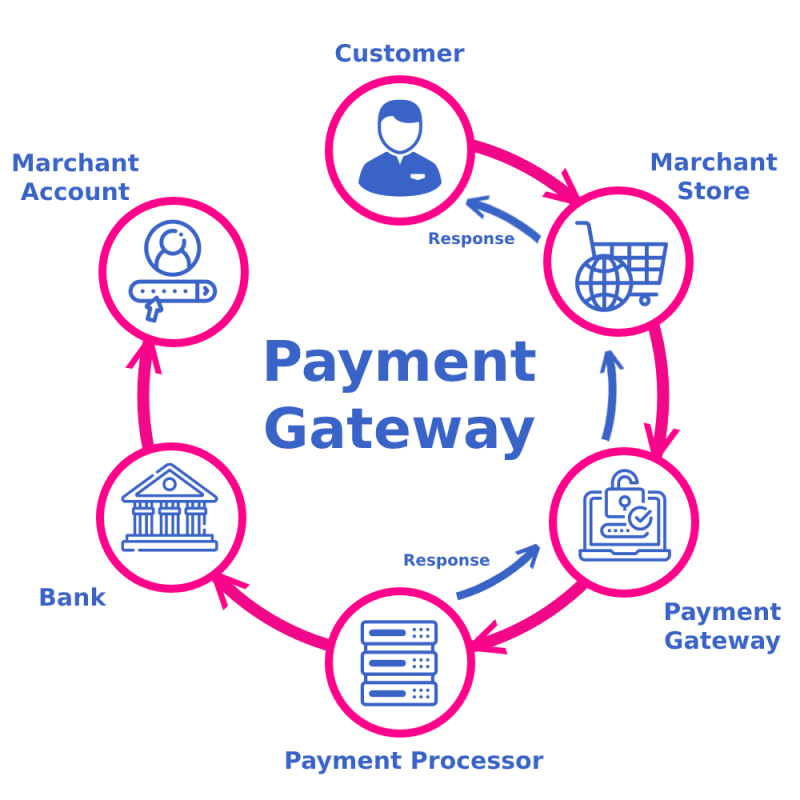

Introduction to Payment Gateways

A payment gateway is an e-commerce application service provider that authorizes payments between a merchant and customer, typically for online shopping. It is the equivalent of a physical point of sale terminal located in most retail outlets. Payment gateway services encrypt sensitive information, such as credit card numbers, to ensure that information passes securely between the customer and merchant and also between the merchant and the payment processor.

Payment gateways are important because they provide a secure link between your website and your payment processor, which is necessary for processing card payments online. They also help to ensure that your customers’ credit card details are safe and secure.

There are many different payment gateway providers available, so it’s important to choose one that will work well for your business. The best way to do this is to research each option carefully and compare features and pricing. You should also make sure that the payment gateway you choose is compatible with your website platform and shopping cart software.

Once you’ve selected a payment gateway, you’ll need to set up an account with them and integrate their code into your website. This can usually be done easily with a few clicks of a button. Once everything is set up, you’ll be able to start taking card payments on your website easily and securely!

Advantages of Payment Gateways

There are many advantages of using payment gateway when taking card payments online. The most obvious advantage is that they provide a secure way to process payments. This is important as it helps to protect both the buyer and the seller from fraud.

Another advantage of using a payment gateway is that they can help to streamline the checkout process. This is because buyers do not need to leave the site to enter their payment details. This can help to increase conversion rates as it makes the buying process quicker and easier.

Finally, payment gateways can also offer additional features such as customer management and reporting tools. This can be beneficial for businesses as it allows them to track sales and understand their customers better.

The 5 Best Payment Gateways

There are a number of different payment gateway options available for businesses wanting to take card payments online. Here are the five best options:

1. PayPal

One of the most popular and well-known payment gateway providers is PayPal. They offer a wide range of features and services that make them a great choice for businesses of all sizes. PayPal is one of the easiest ways to take payments online, and they offer a high level of security to keep your customers’ information safe. You can also use PayPal to send invoices and track payments, making it a very handy tool for business owners.

2. Stripe

There are a lot of payment gateways out there, but not all of them are created equal. Stripe is one of the best payment gateways for taking card payments online easily and securely. Here’s why:

- Stripe is PCI compliant, meaning that it meets all the security requirements for taking card payments online. This is important for protecting your customers’ data and ensuring that their payments are processed safely and securely.

- Stripe also offers 3D Secure, which is an extra layer of security for online card payments. This means that your customers’ payments are even more secure when using Stripe.

- Stripe is easy to use, both for you and your customers. Setting up an account and taking payments with Stripe is quick and easy, and your customers will find the checkout process straightforward and simple.

- Stripe supports a wide range of currencies, so you can take card payments from customers all over the world. And if you’re selling digital products or services, you can use Stripe to accept payments in over 135 different countries.

If you’re looking for a payment gateway that’s easy to use, secure, and supports a wide range of currencies, then Stripe is a great option.

3. Authorize

If you’re looking for a payment gateway that’s both easy to use and secure, Authorize.Net is a great option. With Authorize.Net, you can accept credit and debit card payments online with ease. Plus, Authorize.Net is backed by Visa and Mastercard, so you can be confident that your transactions are safe and secure.

4. Square

There are a number of reasons why Square is one of the best payment gateways for taking card payments online. First and foremost, it is incredibly easy to use. You can simply sign up for an account and then start taking payments via credit or debit card with just a few clicks.

What’s more, Square is extremely secure. All of your payments are processed through a secure gateway, meaning that your customers’ details are always safe. Plus, if you ever have any problems with your account, you can rest assured that customer support is always on hand to help you out.

Finally, Square is very competitively priced. There are no hidden fees or charges, so you can be sure that you’re getting great value for money.

5. Braintree

Braintree is a popular payment gateway for online businesses, and for good reason. It’s easy to set up and use, and it’s very secure. You can accept payments from all major credit and debit cards, as well as PayPal. There are no setup fees or monthly charges, and you only pay when you actually process a payment. Fees are 2.9% + $0.30 per transaction.

Security Considerations with Payment Gateways

When you’re taking card payments online, you need to be sure that your payment gateway is secure. Here are a few things to consider when choosing a payment gateway:

- How easy is it to set up the payment gateway? You should be able to do it yourself without too much trouble.

- Is the payment gateway PCI compliant? This means that it meets the security standards set by the Payment Card Industry.

- Does the payment gateway offer 3D Secure? This is an extra layer of security that can help protect your customers’ card details.

- Does the payment gateway have fraud prevention features? These can help you avoid taking payments from fraudulent cards.

- Is customer support available if you need help using the payment gateway? It’s important to be able to contact someone if you have any problems.

Tips for Choosing the Right Payment Gateway

There are a few things to consider when choosing a payment gateway for your online business. Here are some tips to help you choose the right one:

- Check out the fees. Some payment gateways charge per transaction, while others have monthly or annual fees. Make sure you know what all the fees will be before signing up for a gateway.

- Consider ease of use. You want a gateway that is easy to set up and use, so that you can get started taking payments as quickly as possible.

- Look for security features. Make sure the gateway you choose has features in place to keep your customers’ information safe and secure.

- Compare features and benefits. Once you’ve narrowed down your choices, take a closer look at each gateway’s features and benefits to see which one is the best fit for your business needs.

Also Read: How to Sell and Buy on Nifty Gateway

Conclusion

In conclusion, we discussed five of the best payment gateways for taking card payments online easily and securely. These payment gateways offer a convenient way to accept payments from customers without having to worry about security or data protection concerns. Whether you are looking for an all-in-one solution or need specialized features, there’s sure to be something that fits your needs. With these top-notch solutions at your disposal, it’s now easier than ever before to take secure card payments online with confidence.

![How to Pause Location on Find My iPhone Without Them Knowing? [2024] 17 how to pause location on find my iphone](https://izood.net/wp-content/uploads/2024/10/How-to-Pause-Location-on-Find-My-iPhone-Without-Them-Knowing-400x300.png)

![How To Inspect Element on iPhone [4 Methods] 20 how to inspect element on iphone](https://izood.net/wp-content/uploads/2024/10/how-to-inspect-element-on-iphone-3-400x300.png)