Are you tired of feeling lost when it comes to understanding trading patterns? Look no further! In this guide, we will be diving into the descending triangle pattern – a powerful tool for traders looking to make informed decisions in the market. Whether you’re a seasoned trader or just starting out, understanding this pattern can give you an edge and help increase your profitability. So grab your notebook and let’s explore the ins and outs of the descending triangle pattern together!

You can also read: Unpacking the Future of VeChain: Predictions for 2024

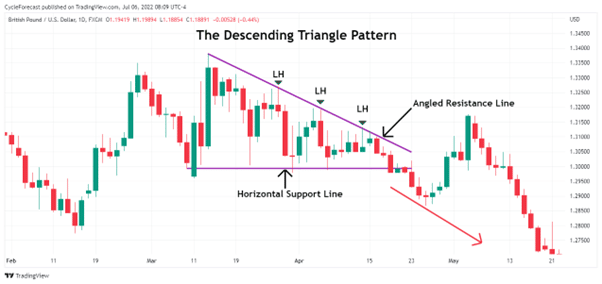

Introduction to the Descending Triangle Pattern

Descending triangles are one of the most popular chart patterns among traders. This is because they are easy to spot and can often lead to profitable trading opportunities.

The descending triangle pattern is created when there is a series of lower highs followed by a single lower low. This creates a downward-sloping trendline that converges with a horizontal support line. The breakout from this pattern usually occurs on the downside, which can lead to some very profitable trade setups.

There are a few things to keep in mind when trading descending triangles. First, it is important to wait for a confirmed breakout before entering any trades. Second, you will want to target the same area as the breakout point for your stop loss. And finally, you will want to take profits quickly once your trade is in profit, as this pattern can often reverse suddenly.

If you keep these things in mind, trading descending triangles can be a very profitable endeavor!

Characteristics of the Descending Triangle Pattern

The descending triangle is a bearish chart pattern that signals a continuation of the downtrend. The pattern is created by drawing a horizontal line across the lows of the price action and then connecting the highs with a downward-sloping trendline.

The descending triangle is considered a bearish pattern because it generally forms during a downtrend and the price tends to break lower out of the pattern. A breakdown below support would confirm the move lower and could lead to further downside in price.

The descending triangle is typically considered a continuation pattern, but it can also mark a reversal of an uptrend. In either case, traders will watch for a breakout below support or a breakdown above resistance to signal which direction the market is likely to move.

Advantages and Disadvantages of the Descending Triangle Pattern

The descending triangle pattern is a bearish chart pattern that is created when the price action of an asset creates a series of lower highs and a single lower low. This technical analysis tool can be used by traders to identify potential reversals in the market, as well as gauge the strength of the current trend.

While the descending triangle pattern does have some advantages, there are also some disadvantages that traders should be aware of. Below, we will take a look at both the pros and cons of this chart pattern.

Advantages:

- The descending triangle pattern is relatively easy to identify on a price chart.

- This pattern can be used to confirm other technical indicators or chart patterns, such as a head and shoulders pattern.

- The descending triangle typically forms during downtrends, which can help traders to enter short positions with more confidence.

Disadvantages:

- There is no guaranteed outcome when trading with the descending triangle pattern – prices could continue to fall or reverse course and start moving higher.

- false breakouts are common with this pattern, which can trap unwary traders on the wrong side of the market move.

- The descending triangle pattern is only relevant for a short period of time, which means that traders may be left waiting for the setup to form before taking a position.

How to Interpret a Descending Triangle Pattern?

A descending triangle is a bearish chart pattern that is created when the price of a security moves lower while simultaneously encountering resistance. This resistance is created by the trendline connecting a series of lower highs. The resistance line becomes steeper with each successive high, which creates the descending triangle shape.

The descending triangle pattern is considered to be a bearish continuation pattern, which means that it typically forms during downtrends and signals that the selling pressure is likely to continue. However, this pattern can also form during uptrends, in which case it would be considered a bearish reversal pattern.

There are several ways to interpret a descending triangle pattern. One way is to look at the height of the triangle, which can give you an idea of how far the price is likely to move once it breaks out from the triangle. For example, if the triangle has a height of $1, then the price is likely to move down by $1 once it breaks out from the triangle.

Another way to interpret a descending triangle pattern is to use technical indicators such as moving averages or Bollinger Bands®. For example, if the 50-day moving average crosses below the 200-day moving average while prices are still inside the descending Triangle, this could be interpreted as a bearish signal.

You can also use Fibonacci levels to help you interpret a descending triangle pattern. For example, if prices break out from the triangle on heavy volume and move

Strategies for Trading the Descending Triangle Pattern

Descending triangles are continuation patterns occurring when the market is downtrend. The descending triangle is a bearish pattern that is created by a horizontal line of resistance and a downward-sloping line of support.

The descending triangle pattern is considered to be one of the most reliable bearish reversal patterns. The descending triangle pattern can be used to trade both reversals and continuations in a downtrend.

When trading the descending triangle pattern, it is important to keep an eye on the volume. The volume should decrease as the prices approach the horizontal line of resistance. This decrease in volume indicates that the sellers are losing steam and the buyers are starting to step in.

The best time to enter a short position is when the prices break below the downward-sloping line of support. The stop loss can be placed above the horizontal line of resistance. The target for this trade can be set at the previous low or at a Fibonacci level.

Alternatives to the Descending Triangle Pattern

The descending triangle pattern is a bearish trend reversal pattern that typically forms during downtrends. The pattern is created by a horizontal support line and a downward-sloping resistance line. As the downtrend continues, the sellers become more aggressive and push prices lower. This eventually makes a breakout below support, which signals a continuation of the downtrend.

There are several alternative patterns that can signal a continuation of a downtrend. These include the head and shoulders pattern, the bearish flag pattern, and the bearish wedge pattern. Each of these patterns has its own distinct characteristics, but they all share one common feature: they all have a downward-sloping trendline that signals a continued selloff.

Conclusion

Understanding the descending triangle pattern is a valuable tool for traders. Whether you are just getting started in trading or have been an experienced trader for years, having the knowledge of this technical analysis pattern can help you make more informed trades and give you an edge over other investors. With practice and experience, recognizing these patterns will become second nature and could lead to greater profits from your investments.