If you live in the United States and the United Kingdom, you should know that Cash App is one of the most popular apps for transferring money. Some of the most significant users of this app are business owners and entrepreneurs who use it to sell their goods and services and manage their businesses more quickly. When you are here, it is supposed that you need to find more data about the cash app business account and its details to decide whether it suits you. So, don’t waste time and keep reading to learn more about the details of cash app for business.

What is a Cash App business account and how does it work?

To understand what a Cash App business account is and its function, first we want to explore a regular Cash App personal account, which is usually used for one’s transactions. A simple example is when you owe some cash to one of your friends and look for a simple way to send money. But this option would not be a great solution if you are a small business owner or an entrepreneur. So, the company decided to start a new online branch of the cash app for businesses that over 51 million users now use. It offers convenient payment methods, like $Cashtag, email, phone number, or Cash App QR code.

Now that you know the meaning of a Cash App business account, you might be wondering how it works, which is not hard to explain. This app works much like the personal ones, with the simple difference that it helps you keep your personal and business transactions separate while you get the 1099-K form for tax filing, which makes it possible for you to avoid reviewing all transactions and labeling them accordingly. Also, it allows you to access the Savings, Bitcoin, and Stocks sections.

Cash app business account Pricing

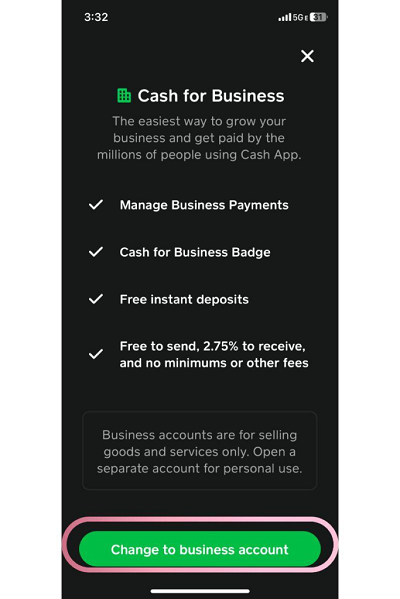

Also, the pricing of the Cash App business account is the main factor that you should think about to decide whether it is a good idea to open such an account or not. And to help you at this point, I should add that you can start this account for free but not use it freely. Based on the app rules, all business cash transactions will automatically incur a 2.75% processing fee. If you are used to working with a personal account, it would be a bummer for you, but you should not ignore the benefits of using Cash App business accounts; for example, there are no instant deposit fees to send money to your bank account. Also, it is worth noticing that when you decide to speed up the process, like instant money transfer to your debit card, the app will charge a 0.5–1.75 percent fee.

How to make a cash app business account?

In this paragraph, I want to explain the process of making a cash app business account in simple words, so just follow the below steps and own your account.

- Download the Cash App from the App Store or Google Play.

- Now, create a Cash App personal account.

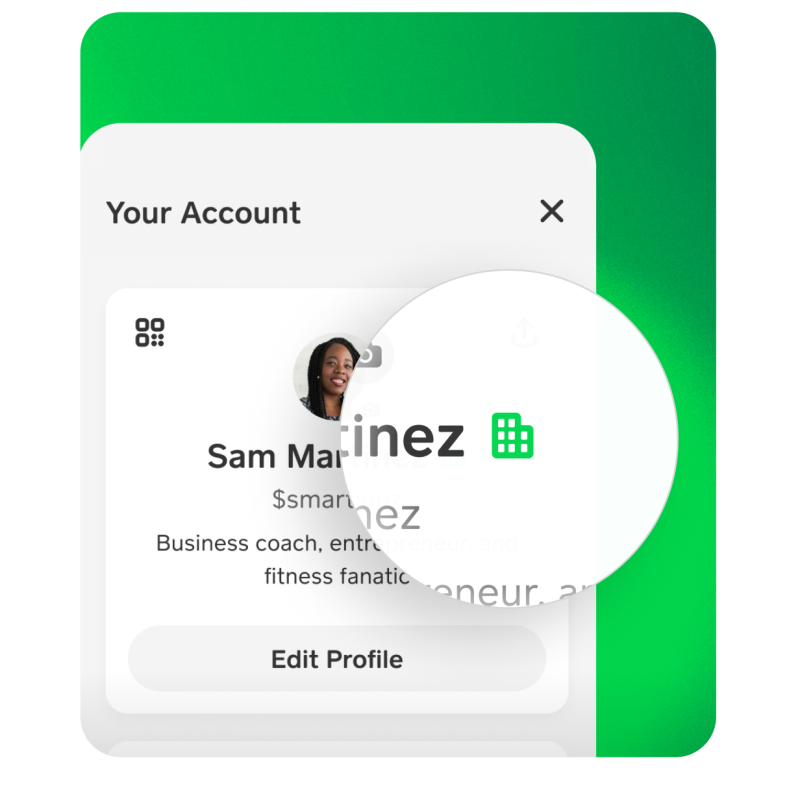

- Choose the person icon from the top right side and go to your account information

- Click on Edit Profile below your name, go down, and find the “Switch to a business account” option.

- Choose the green button and change your account on the page that describes “Cash for Business”.

- Confirm the message you received.

- Then, you will be asked to link your account to your business bank account by clicking on “Linked Banks” and following the directions.

- After that, it’s time to provide your full name and social security number and verify your Cash App account.

Switch a Cash App account from personal to business

If you already have a personal account and want to change it to a business one, whether it was a mistake or if you just decide to change it and do business or get paid, but don’t know how, there is nothing to be worried about. Just spend a few moments, read the below steps, follow them, and reach your goal.

- Open Cash App and log into your account, then go to the Home section.

- Tap on your profile, and go down to find Settings – Personal.

- Where you see your account personal information, you should scroll down to find “Change Account Type”.

- Click on it and you will see the “Cash For Business” screen.

- Choose the “Change this account” button and continue the process.

- Finally, confirm the notification asking you if you are sure to change the account.

- And you will have a Business Account on Cash App.

The Pros and Cons of the Cash App Business Account

To help you make the most noteworthy decision, we have made a complete list of advantages and disadvantages that you and your business will experience by using a Cash App Business Account:

Pros of the Cash App business account

- Unlimited Transactions:

A large group of Cash App business account users believe that the most important advantage of this program is that you, as a company, will have an account without payment or transaction limits, while the owner of Cash App personal accounts will be limited to $1,000 in monthly transactions.

- High-speed payment processing:

As a Cash App Business account customer, you can avoid the delays and service interruptions associated with conventional payment processors.

- Easy documentation for taxes:

If you are a business owner and have a Cash App business account, you will be offered more than $600 in gross sales with tax documentation, which makes tax filing easier.

- Fast-speed funds receiving:

Also, this app business account allows businesses to receive funds quickly through the instant deposits feature that is possible with business debit cards and ranges in price from 0.5% to 1.7%.

- Competitive pricing:

And finally, in comparison to other alternatives, the Cash App Business Account credit card processing fee is lower than the industry average. For example, Stripe charges just 2.9% for credit card processing, while it is about 2.75% for Cash App.

Cons of the Cash App business account

While this app is popular among business owners, that does not mean there are no disadvantages to this app. And by knowing them, you will have a more complicated idea about this topic and can make the best decision.

- High transaction fees:

As you read above, the users who choose to work with Cash App Business Account should pay about 2.75 percent fee for credit card transactions and 2.50 percent for debit card and Cash App account transactions. The fact is that this fee is much higher than other alternatives, such as Zelle, which is free, or Venmo, which does the same for just 1.9% plus 10 cents.

- Limitations for high-risk businesses:

Many users believe that one of the main disadvantages of the Cash App is that it has strong limitations for a group of jobs, called high-risk businesses, such as online pharmacies, telemarketing, betting or gambling services, adult entertainment, and firearm sales. Also, the app monitors abnormal account activities, like a high number of chargebacks to detect account suspension for high-risk businesses.

- Receipt Requirements:

Finally, based on Cash App rules, any business should have a receipt for transactions over $15 and a signature for purchases over $25. So, providing receipts and signatures will be difficult or even impossible for those with high transaction volumes.

How to receive money from a business account on cash app?

Previously, you read that it is possible to use Cash App Business to receive payments from your customers while the app takes a 2.75% processing fee and allows you to get access to your funds instantly. For example, you can make payment links, and anyone can use them to send money to your business account. To know more about the details of this process, follow the below steps:

- Open the Cash App.

- Type the amount you want to receive.

- Click on the Request button.

- Enter an email address, phone number, or £Cashtag.

- Also, you can explain the reason you want this fund if you want.

- Again, select the Request option, and that is over.

Note: When you request money, the person can accept your request within 14 days, otherwise it will be rejected and deleted.

Personal Vs. business Cash App?

Now that you know all the ins and outs of the Cash App Business account, if you still can’t decide whether to convert your account to a business cash app account, the only thing that will help you is to read this comparison that compares Personal VS. business Cash App in detail.

- Purpose:

A personal account is helpful for those who want to send and receive money from family and friends, while a business account is designed for businesses that want to accept payments from customers.

- Features:

As a user of the Personal Cash App account, you will benefit from several features, such as sending and receiving money instantly, linking a debit or credit card, requesting money from others, making payments at participating retailers, and receiving a Cash App debit card for free, while Cash App business account offers more additional features, like accepting payments from customers, sending invoices, setting up recurring payments, issuing refunds, viewing transaction history, and accessing real-time reporting.

- Fees:

The other difference is that you can use your Cash App personal account for free, but as a Cash App business account user, you have to offer a 2.75% fee for every transaction to the company.

- Number of users:

Each personal Cash App account is only available for one user, while multiple users can use a business account.

- Customization:

Cash App business accounts offer customization options for payment options, branding, and POS integration that personal accounts lack.

- Security:

Finally, I should add that both Cash App personal and business accounts are secure and safe because they use encryption to protect user information.

Also Read: How to Make Money on Cash App?

Conclusion

In the above text, you read all the details about the Cash App Business account, its features, advantages, disadvantages, and how to own one. Also, there we made a quick comparison between the Cash App personal and business accounts. But if you still have a question not answered above, you can check their official site or contact us by commenting below. So, we will try to find the best answer for you.

FAQ:

- Can a business open a Cash App account?

Of course, yes. Businesses, whether small or large companies can benefit from the option of a Cash App business account.

- Is Cash App a business bank account?

No, this company is not a bank and does not offer banking services.

- Can you have a personal and business Cash App?

Yes, you can create a separate personal account and keep your own payments separate from your business payments.

- Is Cash App good for small business?

Yes, it’s a useful option to make finances easier and more organized, even for small businesses.

- Can you have two Cash App accounts?

The answer is yes. You can have two or more Cash App accounts as long as you use a separate email address and phone number for each one.

![How to Pause Location on Find My iPhone Without Them Knowing? [2024] 22 how to pause location on find my iphone](https://izood.net/wp-content/uploads/2024/10/How-to-Pause-Location-on-Find-My-iPhone-Without-Them-Knowing-400x300.png)