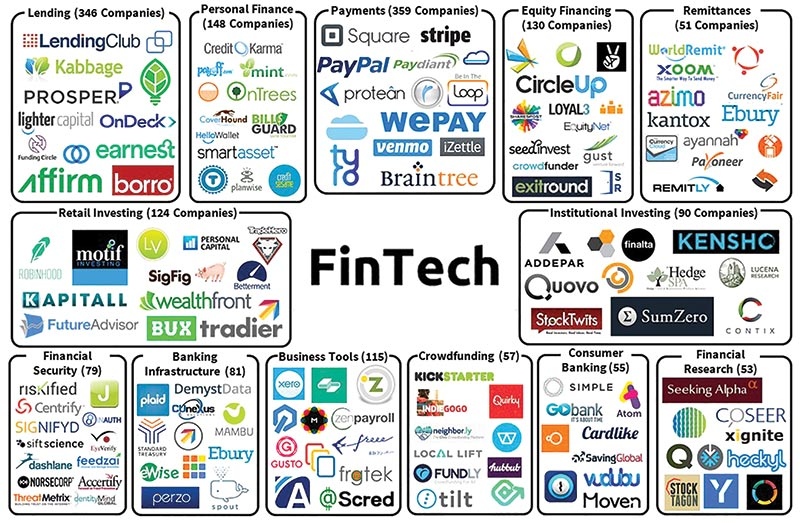

Financial services have been around for centuries, with banks and financial institutions providing essential services to billions of people across the world. However, we are now living in a time where the way we bank and spend is changing on an unprecedented scale. Fintech is the word used to describe new technology that seeks to improve and automate the delivery and use of financial services.

-

Cash App

-

Robinhood

-

Arcesium

-

Circle

-

T-REX

-

Capitalize

-

CAIS

-

Check

What is Fintech?

Fintech is short for financial technology. It encompasses any technology that can be used to help deliver financial services. This includes everything from mobile banking apps to cryptocurrency exchanges.

Fintech has been growing in popularity in recent years, as more and more people turn to digital solutions for their financial needs. This trend is only expected to continue, as fintech offers a convenient and efficient way to manage money.

You can also read: Best 8 Touch Bar apps for MacBook Pro

There are a variety of fintech companies operating in the market today, offering a wide range of products and services. Some of the most well-known names include Robinhood, Square, and SoFi. As the industry continues to evolve, we can expect to see even more innovative solutions emerge.

The future of fintech looks very bright indeed. With its convenience and effectiveness, there’s no doubt that it will continue to grow in popularity and change the way we think about financial services.

1. Cash App

Cash App has made navigating finances more accessible with its mobile platform. Customers can complete instant transactions, set up direct deposits and customize debit cards. Cash App is also the first company to offer stocks and bitcoin as a purchase option. With these various financial capabilities at your fingertips, you can take control of your finances.

Pros:

- Instant transactions

- Easy to set up and use

- Customizable debit cards

- Can purchase stocks and bitcoin

- Empowers people to take control of their finances

Cons:

- May be difficult to track spending if not used carefully

- Cannot cancel transactions after they have been made

- Bitcoin prices can be volatile

2. Robinhood

Invest on your own and take control of your financial future. Robinhood is an investment application that allows you to trade for free from a desktop or mobile device. Invest in cryptocurrencies, stocks, ETFs, and more without paying a commission. No account management fees means tracking investments has never been easier.

Pros:

- Free to use

- No account minimums

- Easy to use interface

- Accessible from mobile devices

- Social media integration

Cons:

- No human interaction/customer service

- Limited investment options (no mutual funds or bonds)

- Only supports US-based stocks and ETFs

3. Arcesium

Arcesium is a company that provides financial data management services, review investment risks, and real-time status reports on reconsolidation. They are the perfect partner for hedge funds, brokers, and private market investors because of their flexible pricing options and high-quality service.

Pros:

- A cloud-based network that enables companies to make informed business decisions

- The network offers financial data management services, review investment risks

- Clients include hedge funds, brokers, and private market investors.

- Has a team of experienced professionals who are able to provide insights and recommendations.

- A well-established company with a good reputation in the industry.

Cons:

- The subscription fee for the service is expensive.

- The interface of the platform can be challenging to use.

- There is a learning curve associated with using the platform effectively.

4. Circle

Circle‘s products are guided by the principle that money should be open and free, but secure. The company’s products include a wide selection of coins that allow users to easily transfer money across countries and currencies, both online and in-person. Circle has its own digital currency, Circle Pay, which is integrated into its products.

Pros:

- Free and open source digital currency

- Fast transactions with low fees

- Decentralized

- Available on multiple platforms

- Transparent development team

Cons:

- Still relatively new and unknown

- Limited number of coins available

- Some have raised concerns over security

5. T-REX

T-REX provides a suite of analytics tools for the financial services industry, with features that allow for complex investments to be tracked easier. Their platform has features like risk management, cashflow modeling, portfolio management, and reporting. Additionally, customers can create their own asset framework, utilize the asset class templates provide, or connect with Managed Data Services.

Pros:

- Complex investment tracking made easy

- Risk management features

- Cashflow modeling

- Portfolio management

- Reporting

Cons:

- Not suitable for small investments

- Limited customer support

- High subscription fees

6. Capitalize

Moving retirement funds from one job to another can be a daunting task. That’s why we created Capitalize to help individuals move their 401(k) into an IRA and consolidate their funds as they move jobs. Through partnerships and technology, we help individuals make the process free so that you can focus on managing your money and growing it for retirement.

Pros:

- Free to use

- Consolidates retirement funds into one account

- Easy to use

- Fast and simple process

- Partnerships with major companies

Cons:

- Limited investment options

- No human interaction/advice

- May not be available in all states

7. CAIS

CAIS is the first of its kind in the financial industry. The company does not offer funds or products but instead provides advisors with a learning system to help them find the funds and products that are right for their clients. CAIS also provides advisor access to alternative investment vehicles like hedge funds, digital assets, private equity, and more.

Pros:

- Helps advisors improve their knowledge about alternative investment products

- Makes it easier for advisors to access these products

- Can improve client outcomes

- Offers a variety of different investment products

- Has a learning system to help advisors understand the products better

Cons:

- Some advisors may not be comfortable with using alternative investment products

- Clients may not be interested in these types of investments

- There is a learning curve for advisors who are new to the CAIS platform

8. Check

Check is an end-to-end payroll system that empowers businesses to focus on their core competencies. Embed payroll into any time tracking, HR, or SaaS program and forget about the tedious filing process for tax forms, state contributions, and monthly reconciliations. Check also offers a simple way for businesses to offer benefits through SimplyInsured.

Pros:

- Very simple to use and set up

- Offers a payroll-as-a-service API that makes it easy to calculate taxes and generate tax forms

- Can be used to offer employee benefits through SimplyInsured

- Offers excellent customer support

Cons:

- There is no free trial available for Check

- Some users have reported that customer support is not always responsive

- Some of the features offered by Check are only available in the paid version

Future of Fintech

Fintech, or financial technology, is one of the hottest sectors in the tech world right now. And it’s only getting hotter.

There are a few reasons for this. First, the rise of mobile and digital banking has made it easier than ever for people to manage their finances on their own terms. Second, the traditional financial system is ripe for disruption. From high fees to outdated systems, there are plenty of areas where fintech can make a big impact.

So what does the future hold for fintech? Here are a few predictions:

1. Big data will play a big role.

Fintech companies are already using data to provide better services and products to their customers. But in the future, data will become even more important. With access to real-time data, fintech companies will be able to provide even more personalized service and products. Additionally, data will help fintech companies identify trends and opportunities faster than ever before.

2. Blockchain will go mainstream.

Blockchain technology is already making waves in the fintech world. But in the future, it will become even more mainstream. That’s because blockchain offers a secure and efficient way to process transactions without the need for a third party (like a bank). This could potentially revolutionize the way we bank and do business.

3. Artificial intelligence will take over repetitive tasks.

AI (artificial intelligence) is already being used by some fintech companies to automate repetitive tasks. For example, AI can be used to process customer service requests or to detect fraud. In the future, AI will become even more prevalent in fintech. That’s because AI can help companies scale their operations without adding more headcount. Additionally, AI can help fintech companies provide even better service to their customers by constantly learning and improving.

Conclusion

Fintech is an industry that is constantly evolving and growing. With new technologies emerging all the time, it can be difficult to keep up with the latest trends. However, by staying informed and keeping up with the latest news, you can ensure that you are always ahead of the curve. The future of fintech is looking very bright, and we can’t wait to see what innovations come next.

![How to Pause Location on Find My iPhone Without Them Knowing? [2024] 18 how to pause location on find my iphone](https://izood.net/wp-content/uploads/2024/10/How-to-Pause-Location-on-Find-My-iPhone-Without-Them-Knowing-400x300.png)

![How To Inspect Element on iPhone [4 Methods] 21 how to inspect element on iphone](https://izood.net/wp-content/uploads/2024/10/how-to-inspect-element-on-iphone-3-400x300.png)